Most financially stressed states

-

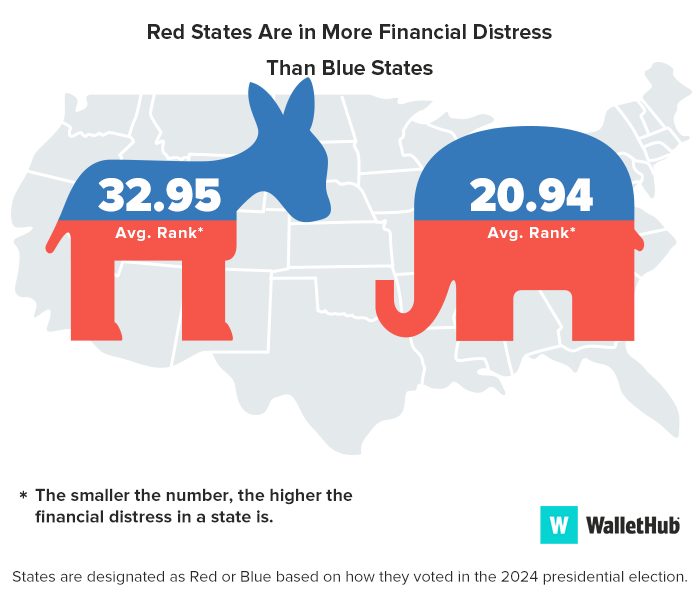

The last few years have been a whirlwind for Americans’ finances, with inflation, fluctuating unemployment, public health crises and natural disasters making it hard for people across the country to pay their bills. Ultimately, many people have ended up in financial distress, which WalletHub defines as having a credit account that is in forbearance or has its payments deferred, meaning the account holder is temporarily allowed to not make payments due to financial difficulty.

In order to shed light on the financial troubles experienced by people across the U.S., and to show where those difficulties are most pronounced, WalletHub compared the 50 states across nine key metrics. Our data set includes factors like the average credit score, the change in the number of bankruptcy filings between March 2024 and March 2025, and the share of people with accounts in distress.

https://wallethub.com/edu/states-with-the-most-people-in-financial-distress/130790

-

This is totally dumb. These averages tell you nothing about the political (red/blue) drivers of financial stress. Poor states have more people in distress than rich states. Just so happens that there are more poor red states than blue states. Duh.

The people who write this stuff are usually weak journalists who have a shiny degree in communications or literature. The kind of people who will nod when they hear "correlation isn't causality" without having a clue what that means.